Address

Room 2301C, 23rd Floor, Building 1, jinghu Commercial center, No, 34, Liangzhuang Street, Eri District, Zhengzhou City, Henan province

Woours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Address

Room 2301C, 23rd Floor, Building 1, jinghu Commercial center, No, 34, Liangzhuang Street, Eri District, Zhengzhou City, Henan province

Woours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

The following information is available regarding China and Polysilazane Merck:

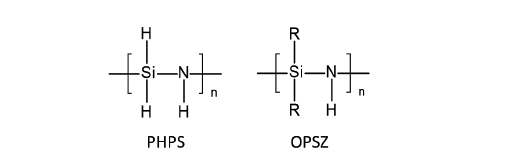

Introduction to Polysilazanes

Polysilazanes are a class of inorganic-organic hybrid polymers composed of silicon, nitrogen, and hydrogen, with the general formula [R2Si−NH]n[R2Si−NH]n (R can be hydrogen, alkyl, or aryl). Their characteristics include:

High-temperature resistance:

It can be converted into ceramics (such as SiCN or Si3N4) at high temperatures, enabling its use in coatings and composites.

Chemical stability:

It offers corrosion and oxidation resistance.

Applications:

Ceramic precursors, protective coatings, electronic packaging, aerospace materials, etc.

Polysilazane Merck VS China polysilazane

Merck as a long-time leader in the global polysilazane market, boasts significant technological strength and market share advantages. However, in recent years, Chinese companies have also made significant breakthroughs in this field. The following is a comparative analysis of the two companies:

1) Polysilazane Market Position and Technological Strength

Merck:

Its global polysilazane market share has consistently remained above 90%, with a particularly dominant position in high-end products (such as perhydropolysilazane). Despite high technical barriers and complex synthesis processes, its products boast purity exceeding 99.999%, meeting the high-precision requirements of sub-5nm semiconductor manufacturing processes.

China companies:

Despite a relatively late start, they have achieved partial substitution in the mid- and low-end markets in recent years through independent R&D and industry-university-research collaborations. For example, the PSN series products of the Chinese Academy of Sciences’ Institute of Chemistry are used in Yangtze Memory Technologies’ 3D NAND chip manufacturing, and China Shipbuilding Industry Corporation’s 600°C temperature-resistant coating is used as an anti-skid coating on aircraft carrier decks.

2) Polysilazane Marck Cost and price competitiveness

Merck:

Due to its technological monopoly and high-end positioning, its products are expensive, with some models selling for thousands of dollars per kilogram.

Chinese companies:

By optimizing production processes and localizing supply chains, they have obvious cost advantages, with prices only 1/3 to 1/2 of Merck’s, making them more suitable for the mid- and low-end markets and large-scale applications.

Product performance and application areas

Performance Characteristics

Surface Hardness and Scratch Resistance: Polysilazane coatings exhibit excellent surface hardness, scratch resistance, and abrasion resistance. For example, a coating based on organopolysilazane exhibits a pencil hardness of 5H after seven days of curing at room temperature, while a coating based on a commercial methyl silicone resin exhibits a hardness of B under the same curing conditions.

Easy Cleaning: Organopolysilazane-based coatings are hydrophobic, with typical water contact angles ranging from 95-105°. Furthermore, their low surface energy provides excellent non-stick, anti-graffiti, and easy-to-clean properties.

Other Properties: They exhibit excellent corrosion, oxidation, radiation, and high-temperature resistance, achieving a hardness exceeding 8H after curing. At high temperatures, they undergo a ceramicization reaction, converting them into a silicon-nitrogen compound with ceramic properties, combining the processability of polymers with the high-temperature resistance and high strength of ceramics.

Applications

Coating Materials: These can be used as protective coatings for vehicles, commercial and residential buildings, and industrial plants, providing optimal protection for a variety of surfaces, including glass, polycarbonate, PMMA, PET, aluminum, iron, galvanized steel, stainless steel, stone, and painted surfaces.

Ceramic Precursors: These are important ceramic precursors, and their market share is expanding amidst the rapid growth of the new materials industry and the increasing demand for ceramic-based materials.

Other Applications: These can also be used for antifouling, snow/ice protection, and other high-end applications in aerospace, semiconductors, photovoltaics, and other high-end industries.

Development Trends and Challenges

Merck: Faced with technological catching up from Chinese companies and policy restrictions (such as a sales ban in China), it needs to increase R&D investment to maintain its technological advantage.

Chinese companies: They need to overcome technical bottlenecks in high-purity synthesis and large-scale production, strengthen intellectual property protection, and increase their international market share.

Merck still holds a clear advantage in technology and market position, but Chinese companies, driven by policy support and market demand, are gradually narrowing the gap. Future competition will focus on technological innovation, cost control, and industrial chain integration. Domestic companies are expected to achieve greater breakthroughs in the mid- and low-end markets, while Merck will have to contend with the dual pressures of technological blockade and market competition.